kansas Counties

State Auction Process in Kansas

Kansas is a Tax state. In a tax deed state, the actual property is sold after tax foreclosure, as opposed to a tax lien state, where a lien is sold against the property, giving the owner the right to collect the back taxes and earn interest. Tax deed states allow the general public to sell and invest in tax deeds. Tax deeds are legal documents that grant the ownership of a property to a governing body or public municipality when the original owner is unable to pay their taxes. The minimum bid includes all back taxes, interest, penalties, and any other costs.

Premium Bid Process in Kansas

In Kansas, the premium bid method is used for the sale of tax deeds. Here’s an overview of how the process works:

1. Tax Delinquency: When a property owner fails to pay property taxes, the county tax collector declares the property as delinquent. The delinquent tax amount includes the unpaid taxes, penalties, interest, and any associated fees.

2. Tax Deed Auction: The delinquent properties are then scheduled for a tax deed auction, which is typically conducted as a public auction. Interested bidders have the opportunity to participate in the auction and bid on the tax deeds.

3. Highest Bidder: During the auction, tax deeds are sold to the highest qualified bidder. Bidders compete by offering premiums, which are additional amounts over and above the delinquent tax amount. The premium bid is the bid amount that the highest bidder is willing to pay for the tax deed.

4. Property Transfer: Once the auction concludes, the highest bidder who successfully secured the tax deed becomes the new owner of the property. The county will transfer the ownership rights and issue a tax deed to the winning bidder.

5. Redemption Period: In Kansas, there is a redemption period for the previous property owner or any other interested party to redeem the property. The redemption period allows the opportunity to pay the delinquent taxes, penalties, and interest to regain ownership of the property. The length of the redemption period varies and is typically determined by state law.

6. Title and Possession: If the property is not redeemed within the redemption period, the winning bidder receives the full ownership rights to the property. They can take possession of the property and may proceed with any necessary eviction or legal procedures to enforce their ownership rights.

Foreclosure in Kansas

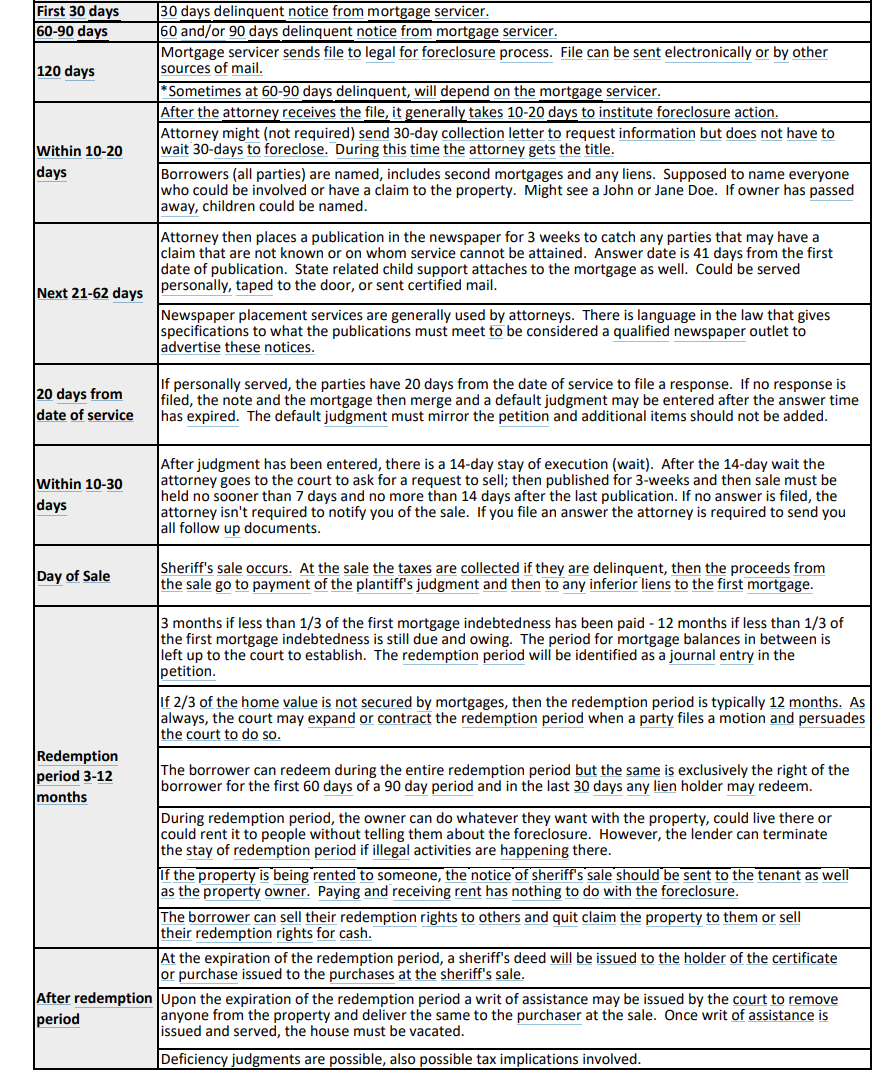

The foreclosure process in Kansas is a judicial process, which means that the lender must file a lawsuit in court in order to foreclose on the property. The foreclosure process typically takes several months to complete.

The following are the steps involved in the foreclosure process in Kansas:

1. Notice of Foreclosure: The lender must serve the borrower with a summons and complaint, initiating the foreclosure lawsuit. If the borrower fails to respond, the lender can obtain a default judgment and proceed with the foreclosure sale.

2. Litigation and Summary Judgment: If the borrower files an answer to the lawsuit, the case proceeds through litigation, including a summary judgment motion or a trial.If the court grants summary judgment or the borrower loses at trial, the lender is granted permission to sell the property at a foreclosure sale.

3.Foreclosure Sale: The foreclosure sale is typically conducted at the county courthouse, and the property is sold to the highest bidder. The court must confirm the sale to finalize the transfer of ownership.

4. Reinstatement and Redemption Period: Kansas does not explicitly provide homeowners with the right to reinstate the mortgage before the foreclosure sale.The redemption period allows the borrower to reclaim the property by paying off the debt within a specific timeframe, usually 12 months.

5.Deficiency Judgments: Kansas allows for deficiency judgments, which means that if the foreclosure sale price is insufficient to cover the outstanding debt, the lender can seek a judgment against the borrower for the remaining amount.

Kansas Foreclosure Timeline

Quick Facts:

– Judicial Foreclosure Available: No

– Non-Judicial Foreclosure Available: No

– Primary Security Instruments: Mortgage

– Timeline: Typically 120 days

– Right of Redemption: Yes

– Deficiency Judgments Allowed: Yes

– Non-Judicial Foreclosure Available: No

– Primary Security Instruments: Mortgage

– Timeline: Typically 120 days

– Right of Redemption: Yes

– Deficiency Judgments Allowed: Yes

Online Auction Resources

- Bid4Assets

- Auction.com

- Xome

- ServiceLink Auction

- Hubzu

- RealtyBid

- All Auction Sales

- HUD Homes USA

- Williams Auction

- Bank Foreclosures Sale

- U.S. Treasury Auctions

- United Country Auctions Kansas

- Sudduth Realty Auctions

- McCurdy Auction

- LandWatch Kansas Auctions

- Kansas Auctions Calendar

- Land Search Auctions Kansas

- Sun Group Real Estate Auctions

- Heritage Auctions

- Lange Real Estate Auctions

- Kansas ABC Auctions

- Griffin Real Estate Auction

- Theurer Auction

- Shawnee County Tax Sale