Florida Counties

Real Estate Auction in Florida

Real estate auctions in Florida offer a unique and dynamic approach to buying and selling properties. Whether you’re a homeowner looking for a quick sale or an investor seeking lucrative opportunities, understanding the auction process can be beneficial. In this guide, we will provide an overview of real estate auctions in Florida, including the process and key considerations. Exploring the Different Types of Auctions in Florida’s Real Estate Market

1. Tax Lien Auctions:

Tax lien auctions in Florida involve the sale of tax lien certificates to investors. When property owners fall behind on their tax payments, the governing municipality sells these certificates to recoup the outstanding taxes. Investors purchase the certificates and earn interest on their investment. If the property owner fails to redeem the certificate within a specified period, the investor may apply for a tax deed and proceed to auction the property.

2. Foreclosure Auctions:

Foreclosure auctions are prevalent in Florida’s real estate market. These auctions occur when homeowners default on their mortgage payments, leading to the lender seizing the property and selling it to recoup the debt. Foreclosure auctions can be initiated through judicial or non-judicial processes, depending on the specific circumstances and state laws. Interested bidders compete to secure ownership of the property through a bidding process.

3. Bank-Owned Property Auctions:

Also known as real estate-owned (REO) auctions, bank-owned property auctions involve the sale of properties that have been repossessed by banks or financial institutions. These properties may have failed to sell at foreclosure auctions and are now offered directly by the bank. Bidders have the opportunity to acquire these properties at potentially attractive prices, as banks are motivated to sell and recover their investment.

1. Tax Lien Auctions:

Tax lien auctions in Florida involve the sale of tax lien certificates to investors. When property owners fall behind on their tax payments, the governing municipality sells these certificates to recoup the outstanding taxes. Investors purchase the certificates and earn interest on their investment. If the property owner fails to redeem the certificate within a specified period, the investor may apply for a tax deed and proceed to auction the property.

2. Foreclosure Auctions:

Foreclosure auctions are prevalent in Florida’s real estate market. These auctions occur when homeowners default on their mortgage payments, leading to the lender seizing the property and selling it to recoup the debt. Foreclosure auctions can be initiated through judicial or non-judicial processes, depending on the specific circumstances and state laws. Interested bidders compete to secure ownership of the property through a bidding process.

3. Bank-Owned Property Auctions:

Also known as real estate-owned (REO) auctions, bank-owned property auctions involve the sale of properties that have been repossessed by banks or financial institutions. These properties may have failed to sell at foreclosure auctions and are now offered directly by the bank. Bidders have the opportunity to acquire these properties at potentially attractive prices, as banks are motivated to sell and recover their investment.

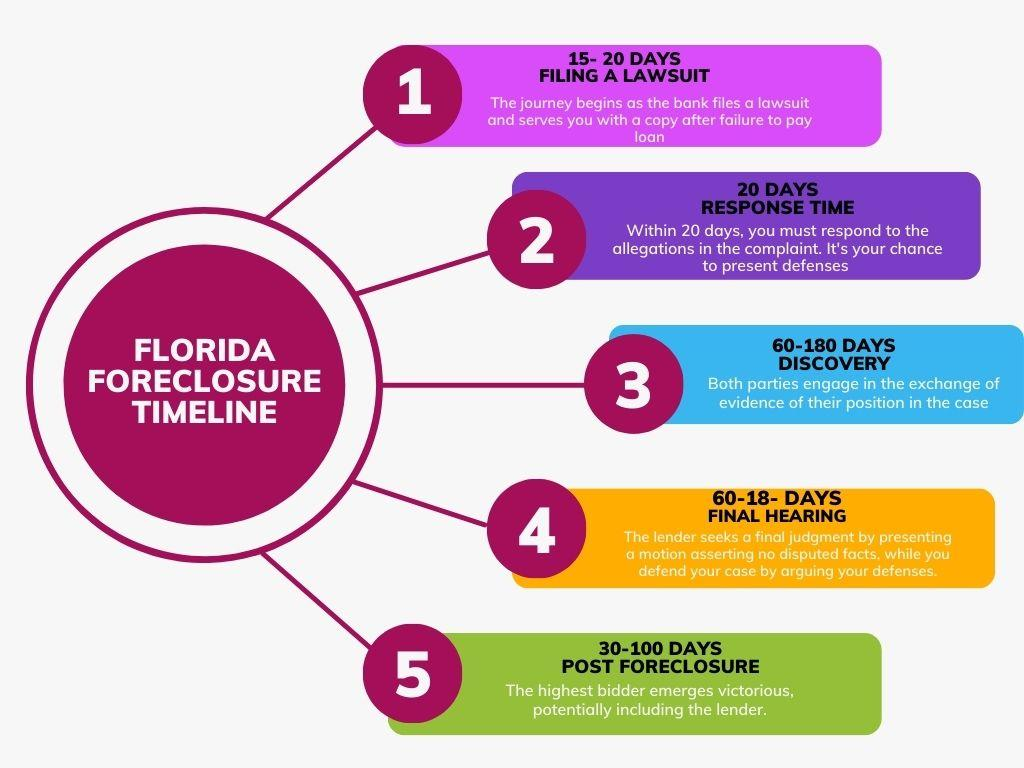

Unveiling the Florida Foreclosure Journey: A Quick Guide

Florida has Judicial Foreclosure. When homeowners in Florida fall behind on their mortgage payments, they may face the possibility of foreclosure. It’s important to understand the foreclosure process in Florida to navigate the situation effectively.

Here are the key steps involved:

1.Default of payment -Default of payment marks the initial stage of the foreclosure process, occurring when a homeowner misses a certain number of payments. The lender will send payment reminder letters, and if no payment is received within a specified period, foreclosure proceedings will commence.

2.Notice of default- Next, a Notice of Default is issued, with the bank recording the defaulted payment of 90 days or more and placing a letter on the home. The homeowner is granted an additional 90 days to settle the outstanding amount and reinstate the loan. It is during this period that potential buyers may start monitoring the property, considering it as an investment opportunity.

3.Notice of Trustee’s Sale- If the loan amount remains unpaid by the end of the notice of default period, the lender proceeds with the Trustee’s Sale process. This involves recording the sale in the county where the property is located and publishing a public notice in the newspaper, specifying the date of the sale. Online platforms may also provide information about the sale date.

4.Trustee’s Sale of Foreclosed Property- This is the public auction that sells the home to the highest bidder. The sale starts with an opening bid that is the minimum that the lender will accept for the home based on the outstanding loan balance, any unpaid taxes, and other costs that will be associated with the sale.

Here are the key steps involved:

1.Default of payment -Default of payment marks the initial stage of the foreclosure process, occurring when a homeowner misses a certain number of payments. The lender will send payment reminder letters, and if no payment is received within a specified period, foreclosure proceedings will commence.

2.Notice of default- Next, a Notice of Default is issued, with the bank recording the defaulted payment of 90 days or more and placing a letter on the home. The homeowner is granted an additional 90 days to settle the outstanding amount and reinstate the loan. It is during this period that potential buyers may start monitoring the property, considering it as an investment opportunity.

3.Notice of Trustee’s Sale- If the loan amount remains unpaid by the end of the notice of default period, the lender proceeds with the Trustee’s Sale process. This involves recording the sale in the county where the property is located and publishing a public notice in the newspaper, specifying the date of the sale. Online platforms may also provide information about the sale date.

4.Trustee’s Sale of Foreclosed Property- This is the public auction that sells the home to the highest bidder. The sale starts with an opening bid that is the minimum that the lender will accept for the home based on the outstanding loan balance, any unpaid taxes, and other costs that will be associated with the sale.

GROUND RULES ABOUT THE AUCTION PROCESS IN FLORIDA:

– No bidders? No problem: If there are no bidders at the auction, the property will be sold to the certificate holder. They will pay the necessary fees, and a tax deed will be issued.

– Deposit required: To participate in the auction, a non-refundable $200 deposit must be paid to the Clerk. This deposit will be applied to the final sale price upon full payment.

– Bid honor: Anyone who previously bid and failed to honor their commitment will not be recognized by the Clerk. – Prompt payment: Full payment must be made within 24 hours (excluding weekends and holidays) to avoid cancellation by the Clerk. Failure to pay will result in re-advertising of the property, with costs deducted from the deposit. The remaining funds will be applied to the opening bid.

– Payment methods: Personal or business checks are not accepted. Only cashiers checks, certified checks, money orders, or cash payments are allowed.

– Bring your ID: A valid photo ID is required for all bidders.

– Time is of the essence: Failure to meet the requirements will result in the sale being rescheduled within 30 days from the original date.

– Deposit required: To participate in the auction, a non-refundable $200 deposit must be paid to the Clerk. This deposit will be applied to the final sale price upon full payment.

– Bid honor: Anyone who previously bid and failed to honor their commitment will not be recognized by the Clerk. – Prompt payment: Full payment must be made within 24 hours (excluding weekends and holidays) to avoid cancellation by the Clerk. Failure to pay will result in re-advertising of the property, with costs deducted from the deposit. The remaining funds will be applied to the opening bid.

– Payment methods: Personal or business checks are not accepted. Only cashiers checks, certified checks, money orders, or cash payments are allowed.

– Bring your ID: A valid photo ID is required for all bidders.

– Time is of the essence: Failure to meet the requirements will result in the sale being rescheduled within 30 days from the original date.

THINGS TO REMEMBER:

1.There are different types of auctions in Florida, including tax lien certificate auctions and foreclosure auctions.

2.Investors can purchase tax lien certificates when property owners fail to pay their taxes. These certificates offer the potential for high interest rates, typically set at 18% in Florida.

3.Florida follows the Judicial Foreclosure system, where the lender files a legal complaint to initiate foreclosure proceedings.

4.Foreclosure auctions in Florida usually involve bidding down by percentages, starting at 18% and potentially going down to 0%.

5.Property owners have a redemption period of at least two years after the tax lien sale to reclaim the property before it’s sold at a tax deed sale.

6.Each county in Florida sets its own payment terms for auction purchases. It is important to be aware of the specific payment deadlines and accepted forms of payment.

7.It’s crucial to understand the auction rules and regulations specific to each county in Florida, as they may vary.

2.Investors can purchase tax lien certificates when property owners fail to pay their taxes. These certificates offer the potential for high interest rates, typically set at 18% in Florida.

3.Florida follows the Judicial Foreclosure system, where the lender files a legal complaint to initiate foreclosure proceedings.

4.Foreclosure auctions in Florida usually involve bidding down by percentages, starting at 18% and potentially going down to 0%.

5.Property owners have a redemption period of at least two years after the tax lien sale to reclaim the property before it’s sold at a tax deed sale.

6.Each county in Florida sets its own payment terms for auction purchases. It is important to be aware of the specific payment deadlines and accepted forms of payment.

7.It’s crucial to understand the auction rules and regulations specific to each county in Florida, as they may vary.

COUNTY WISE VARIATIONS

Foreclosure rules and specifications can vary from county to county in Florida. While the general foreclosure process is governed by state law, each county may have its own local rules and procedures that need to be followed. These variations can include specific timelines, documentation requirements, court procedures, and other factors that may impact the foreclosure process, which are described below:

Foreclosure Sales (Valid in all 67 Counties)

| CATEGORIES | SPECIFICATIONS |

|---|---|

| Location of Sale | Online or in some counties, auctions are held at their courthouse |

| Day and Time of Sale | Mon-Fri from 11 AM |

| Viewing Foreclosure Files | Link |

| Bidding Registration | Link |

| Deposit amount required to bid | 5% of the estimated highest bid |

| Total Amount Paid after winning the bid | Balance of the final bid plus the court registry fee, and documentary stamps |

| Time Frame to pay the whole amount | 4:00-5:00 or 11:00-12:00 pm on the day of the sale or 11:00-12:00 pm the next business day |

| Registry of the Court Service Charge | 3% of the first $500.00 and 1.5% for everything over $500.00 (in some counties, of each additional $100) |

| Documentary Stamp Taxes | $0.70 per $100.00 of the final bid |

| Forms of Final Payment | Wire transfers, cash, cashier's checks and money orders |

| In the case of Failure of Payment, What will happen to the bid deposit amount? | The bidding deposit amount is non-refundable |

| Clear Title of Property (number of days after filling the certificate of sale) | 10 days |

Just like foreclosures, the process of selling tax deed properties is regulated by state law, but each county may have its own set of rules, procedures, and requirements that govern tax deed sales.

These variations can include specific timelines for tax delinquency, notification methods, bidding processes, redemption periods, payment terms, and other factors that may differ from one county to another. It’s important to research and understand the tax deed rules and specifications of the specific county where you are interested in purchasing a tax deed property.

These variations can include specific timelines for tax delinquency, notification methods, bidding processes, redemption periods, payment terms, and other factors that may differ from one county to another. It’s important to research and understand the tax deed rules and specifications of the specific county where you are interested in purchasing a tax deed property.

Tax Deed (Applicable to all 67 counties)

| CATEGORIES | SPECIFICATIONS |

|---|---|

| Application Fee | 60 dollars as clerk’s fee plus additional costs for advertising, sheriff's service fees, and certified mail fees |

| Life of Tax Certificate (in years) | 7 years |

| Deposit amount required to bid | Deposit of $200.00 or 5% of the anticipated high bid, whichever is greater |

| Location of Sale | Online or in some counties, auctions are held at their courthouse |

| Tax Collector's Website | LINK |

| Viewing Tax Deed Files | LINK |

| Bidding Registration | LINK |

| Registry of the Court Service Charge/ Recording fee | 3% of the first $500 and 1.5% of each subsequent $100 |

| Documentary Stamp Taxes | $0.70 per $100.00 |

| Total Amount Paid after winning the bid | Balance of the bid plus all recording fees and documentary stamps |

| Forms of Final Payment | Wire transfer, cash, cashier's check, or money order |

| Time Frame to pay the whole amount | Within 24 hours or by a certain time the next business day, depending on counties |

Counties Link: Florida.pdfThis is the sheet where you can find information below for the 67 counties in Florida containing

1) Viewing foreclosure files

2) Bidding Registration

3) Tax Collector Website

4) Viewing tax deed files

1) Viewing foreclosure files

2) Bidding Registration

3) Tax Collector Website

4) Viewing tax deed files

Online Auction Resources

- Bid4Assets

- Auction.com

- Xome

- ServiceLink Auction

- Hubzu

- RealtyBid

- Tranzon

- HUD Homes USA

- Real Auction

- Williams Auction

- Concierge Auctions

- Bank Foreclosures Sale

- U.S. Treasury Auctions

- RealtyTrac

- Orange County Property Auction

- GovDeals Florida

- Miami Condo Foreclosure List

- FLA Real Estate Auctions

- Florida Treasure Hunt Auctions