Pennsylvania Counties

Real Estate Auction in Pennsylvania

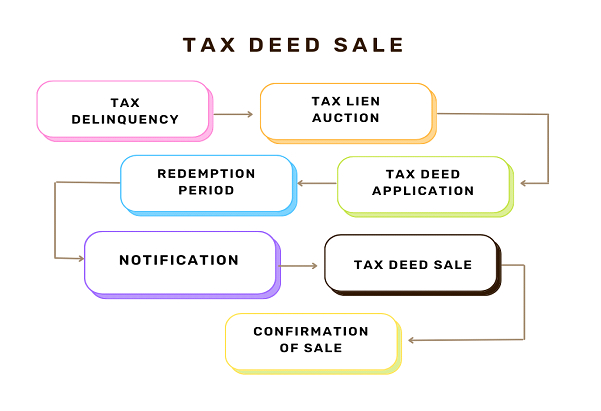

Pennsylvania is a tax deed state, and the process for Pennsylvania tax deed sales is a little more complicated. As in all tax deed states, the local government seizes real estate for delinquent property taxes in Pennsylvania and then sells the property at a tax defaulted auction to the highest bidder in order to recoup the unpaid property taxes and other associated costs. But in Pennsylvania, the tax deed process involves the sale of properties with delinquent taxes through a judicial auction known as the “upset tax sale” or “judicial tax sale.

Upset Tax Sale Process

There is no redemption period in Pennsylvania. When you purchase real estate at Pennsylvania tax deed sales, you own it.

- Auction Companies: Auctions in Pennsylvania are typically organized and conducted by licensed auction companies. These companies specialize in organizing and facilitating the auction process. It’s important to do research and choose a reputable auction company with experience in real estate auctions.

- Auction Organization: Auction companies are responsible for organizing and coordinating the entire auction process. This includes determining auction dates, creating auction listings, and establishing the terms and conditions for participation and bidding.

- Marketing & Advertising: Auction companies handle the marketing and advertising efforts to promote the auction and attract potential buyers. They utilize various channels such as print media, online platforms, social media, and direct marketing to reach a wide audience and generate interest in the auctioned properties.

- Property Evaluation and Preparation: Before an auction, auction companies may assess the properties to determine their market value and potential selling price. They may collaborate with appraisers, surveyors, and other professionals to ensure accurate property evaluations. Additionally, auction companies may oversee property preparation, including photography, descriptions, and gathering necessary documentation.

- Auctioneer Services: Auction companies provide professional auctioneers who conduct the auction proceedings. Auctioneers are skilled at engaging the audience, conducting the bidding process, and ensuring a fair and transparent auction experience. They facilitate the flow of the auction, manage bidding increments, and encourage active participation from attendees.

- Buyer Registration and Support: Auction companies handle the registration process for prospective buyers, verifying their eligibility and collecting necessary information. They provide guidance to potential buyers, answer inquiries, and offer support throughout the registration and bidding processes. Auction companies may also provide bidder education to help participants understand the auction process and requirements.

- Documentation and Contracts: Auction companies assist in preparing the necessary documentation and contracts required for the auction. This includes drafting bidder registration forms, purchase agreements, and other legal documents specific to the auction process. They ensure that all necessary paperwork is completed accurately and in compliance with applicable laws and regulations.

- Payment and Settlement: Once the auction is concluded, auction companies facilitate the payment and settlement process between the buyers and sellers. They collect the winning bid amounts, coordinate the transfer of funds, and ensure that all financial transactions are processed securely and efficiently.

- Compliance and Legal Considerations: Auction companies stay informed about relevant laws, regulations, and licensing requirements pertaining to auctions in Pennsylvania. They ensure compliance with these regulations throughout the auction process to protect the rights of all parties involved.

- Auction Listings: To participate in a real estate auction, you need to access auction listings. These listings provide information about the properties available for auction, including details such as property location, size, condition, and any special terms or conditions. Auction listings can be found on the websites of auction companies or through real estate listing platforms that specialize in auctions.

- Pre-Auction Due Diligence: Before participating in a real estate auction, it’s crucial to conduct thorough due diligence on the properties of interest. This may include researching property records, conducting inspections, reviewing legal documents, and understanding any liens or encumbrances on the property. Due diligence is typically performed independently by prospective buyers before the auction.

- Registration and Deposit: To participate in a real estate auction, you generally need to register with the auction company and provide a deposit. The registration process may involve submitting personal information and proof of funds or financing capabilities. The deposit is typically a percentage of the expected purchase price and serves as a commitment to bid.

- Bidding Process: The auction itself involves a competitive bidding process, where registered participants compete to submit the highest bid. Bids can be made in person at live auctions or through online bidding platforms for online auctions. Bidding increments and rules will be specified by the auctioneer, and the highest bidder will ultimately win the property.

- Sale Completion: If you are the winning bidder at an auction, you will need to proceed with the purchase according to the terms and conditions set by the auction company. This typically involves completing the payment for the property within a specified timeframe and adhering to any additional requirements, such as signing contracts or other legal documents.

Types of Auction:

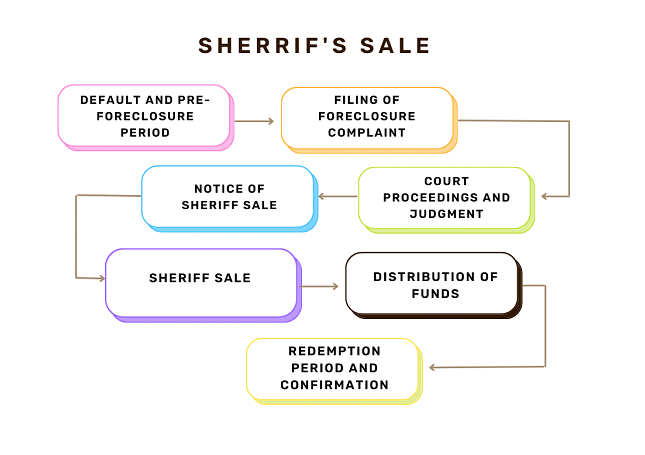

- Foreclosure Auctions: Foreclosure auctions, also known as sheriff’s sales or mortgage foreclosure sales, occur when properties are being sold to satisfy unpaid mortgages or liens. These auctions are typically conducted by the county sheriff’s office or a designated auction company. Foreclosure auctions often offer opportunities to purchase properties at discounted prices, but they may involve certain risks and complexities.

- Grace period: Most lenders offer a 15-day grace period after a missed mortgage payment.

- Foreclosure start: Foreclosure process begins when an individual is 30 days behind on a missed payment.

- Notice of default: Service lender sends a written notice of default.

- Act 6/Act 91 Notice: Sent if person is 60 days behind on payment and owes less than $50,000.

- Notice contents: Includes total late charges, balance due, deadline for payment, details of default, ownership termination explanation, rights to transfer the property, and full mortgage balance due if not cured.

- Pre-foreclosure: Loan remains in pre-foreclosure until the mortgage default is at least 120 days delinquent.

- Court complaint: If debtor doesn’t resolve the default, lender files a complaint with the court.

- 10-day notice: If homeowner doesn’t respond, a 10-day notice is sent by the loan/service lender.

- Response time: Homeowner has approximately 33 days to file a response to the foreclosure complaint.

- Court process: If the judge rules in favor of the creditor, an order of sale is permitted for the creditor to sell the property.

- Notice of Sale: Debtor receives a Notice of Sale posted on the property 30 days before sale, served to parties 30 days before sale, and published in a newspaper once a week for three weeks, with the first publication at least 21 days before the sale date.

- Home on the market: Typically, the home is placed on the market 60 days after the notice of sale is served.

- Foreclosure sale: Property is sold to the highest third-party bidder or reverts back to the lender and becomes real-estate owned. It’s a public auction supervised by the county sheriff.

2. Tax Lien Auctions: Tax lien auctions are held to sell tax liens on properties with delinquent property taxes. These auctions allow investors to bid on the tax liens, and the highest bidder typically receives a tax lien certificate. The certificate grants the investor the right to collect the delinquent taxes, along with interest and penalties, from the property owner. If the owner fails to pay the outstanding taxes, the investor may eventually have the opportunity to acquire the property.

- Upset Sales: Upset Sales are the first type of tax deed sale, and these auctions are held at the county level. All of the liens and judgments will still be attached to the property at the Upset Sale. If you don’t want to pay for everything that’s owed on the property, then you would want to avoid buying at this tax sale.

- Judicial Sales: Judicial Sales are the second type of tax deed sale, also held at the county level. At this auction, the judge removes liens and judgments from the property, including deeds of trust or mortgages. Not all of the liens will be removed. For instance, the property tax lien will certainly remain. However, most encumbrances will be removed, and this is where tax deed investors want to buy.

- Repository Sales: Repository Sales are the third type of county tax deed sale. Leftover properties that didn’t sell at the Judicial Sale are placed on a separate list to be sold at a Repository Sale. Since the treasurer wants to be rid of the properties, it’s possible to get excellent discounts at a Repository Sale.

- Estate Auctions: Estate auctions involve selling properties that are part of an estate or probate process. These auctions typically occur when a deceased person’s property needs to be liquidated to distribute assets among heirs or settle outstanding debts. Estate auctions may include residential homes, commercial properties, land, and other real estate assets.

- Bank-Owned Property Auctions: Bank-owned property auctions, also known as REO (Real Estate Owned) auctions, are conducted by banks or mortgage lenders to sell properties they have acquired through foreclosure. These properties have failed to sell at foreclosure auctions and have become bank-owned. Bank-owned property auctions provide opportunities to purchase properties directly from the lending institutions.

- Distressed Property Auctions: Distressed property auctions encompass the sale of properties in poor condition, such as properties in need of significant repairs, properties with legal issues, or properties facing financial distress. These auctions may attract investors or buyers interested in renovating and reselling the properties for a profit.

Foreclosures in Pennsylvania

Pennsylvania follows the judicial process of foreclosure. It involves the following steps-

- Notice of Intent: In Pennsylvania, the lender must send a notice of intent to foreclose to the borrower before any foreclosure proceedings may begin. The notice of intent must be sent, by first class mail, to the borrower, at their last known address and if different, to the property secured by the mortgage. The notice should not be sent until the borrower is at least sixty (60) days behind in their mortgage payments.

- Filing the Foreclosure Complaint: If the borrower fails to resolve the default, the lender files a foreclosure complaint with the Court of Common Pleas in the county where the property is located. The complaint outlines the details of the default and requests a judgment of foreclosure.

- Service of Process: The borrower is served with a copy of the foreclosure complaint and summons. The borrower has a specific period (usually 20 days) to respond to the complaint. If no response is filed, the lender can request a default judgment.

- Foreclosure Mediation (Optional): In some counties, foreclosure mediation programs are available to help borrowers and lenders explore alternatives to foreclosure and reach a mutually agreeable solution.

- Judicial Foreclosure Sale: If the borrower does not contest the foreclosure or reach a resolution through mediation, the court may enter a judgment of foreclosure. A sheriff’s sale is scheduled, and public notice is given regarding the sale date, time, and location. The property is sold to the highest bidder at the foreclosure sale.

- Confirmation of Sale: After the foreclosure sale, the court must confirm the sale. This involves reviewing the sale process to ensure it was conducted properly and confirming that the highest bid meets certain requirements. Once the sale is confirmed, the winning bidder obtains the title to the property.

- Redemption Period: In Pennsylvania, there is a redemption period following the foreclosure sale during which the borrower has the opportunity to redeem the property by paying the outstanding debt and associated costs. The length of the redemption period varies depending on the circumstances and can range from a few months to a year.

- Eviction Process: If the borrower fails to redeem the property within the redemption period, the winning bidder or new owner can proceed with the eviction process to gain possession of the property.

In the notice, the lender must make the borrower aware that his or her mortgage is in default and that it is their (the lender’s) intention to accelerate the mortgage payments if the borrower does not cure the default within thirty (30) days. This means that the remaining balance of the original mortgage will come due immediately.

If the borrower does not cure the default by paying the past due amount, plus any late charges that have accrued, within the thirty (30) days, the lender may then file a suit to try and obtain a court order to foreclose on the property.

Summary

– Judicial Foreclosure Available: Yes

– Non-Judicial Foreclosure Available: No

– Primary Security Instruments: Mortgage

– Timeline: Typically 90 days

– Right of Redemption: No

– Deficiency Judgments Allowed: Yes

Online Auction Resources

- Bid4Assets

- Auction.com

- Xome

- ServiceLink Auction

- Hubzu

- RealtyBid

- Tranzon Auctions

- HUD Homes USA

- Real Auction

- Williams Auction

- Bank Foreclosures Sale

- U.S. Treasury Auctions

- GovDeals

- Briggs Auction

- HUD Homes USA Landing

- Berks County Home Sales

- Land Search Pennsylvania

- HK Keller Real Estate

- Land.com Pennsylvania Auctions